personal property tax car richmond va

Frederick County levies a personal property tax on automobiles trucks motorcycles trailers motor homes campers mobile homes boats or watercraft airplanes or aircraft and business personal property. 16 2022 to grant relief to Kentucky taxpayers hit with hefty increases in their vehicle property tax bills and endorsed a temporary drop in the.

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Broad Street Richmond VA 23219.

. Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. Monday - Friday 8am - 5pm Mayor Levar Stoney. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

Personal Property Tax. 105 of home value. The vehicle must be owned or leased by an individual and not used for business purposes to qualify for personal property tax relief.

If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value. View qualifications and procedures for. The Fairfax City Council has adopted a lower personal property tax rate of 001 per 100 of assessed value on one motor vehicle owned and regularly used by a qualifying disabled veteran in accordance with Virginia Code 581-3506 A 19.

Volunteer fire EMS police and rescue squad are also eligible for tax relief upon yearly presentation of a letter. Boats trailers and airplanes are not prorated. View the Vehicle Qualification for Personal Property Tax Relief notice for details about tax relief.

Personal Property Taxes are billed once a year with a December 5 th due date. Use this calculator to compute your 2022 personal property tax bill for a qualified vehicle. Richmond City has one of the highest median property taxes in the United States and is.

Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment. As of January 1 2020 Loudoun County is responsible for billing. Personal Property Car Tax Relief.

The assessment on these vehicles is determined by the Commissioner of the Revenue. Personal Property Relief Act 1998 PPTRA Under Virginia law the Commonwealth of Virginia subsidizes a percentage of the tax on the first 20000 of assessed value for vehicles coded as personal use. A vehicle has situs for taxation in the county or if it is registered to a county address with the Virginia Department of Motor Vehicles.

For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at Commissioner of the Revenue. The tax rate is 1 percent charged to the consumer at the time of rental payment. A vehicle is subject to tax if it is normally garaged or parked in the County even if registered in another State.

A higher-valued property pays more tax than a lower-valued property. The Personal Property Tax Relief Act of 1998 provides tax relief for any passenger car motorcycle pickup or panel truck having a registered gross weight of less than 7501 pounds. City Code - Sec.

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. Other Useful Sources of Information Regarding False Alarm Fees. To contact customer service regarding questions about your false alarm bill call toll-free 1-877-893-5267.

I was sent a bill for personal taxes in Richmond and chesterfield I moved to chesterfield in 2018. Is more than 50 of the vehicles annual mileage used as a business. Personal Property Tax Rate.

Beshear took executive action on Wednesday Feb. Active duty military and spouses with states of record other than Virginia are eligible for personal property tax relief. Download the Application for Reduced Personal Property Car Tax Rate for Qualifying Disabled Veterans here.

It is an ad valorem tax meaning the tax amount is set according to the value of the property. Yearly median tax in Richmond City. Proration of personal property tax.

Vehicle decals are not required in Loudoun County. The governing body of any county city or town may provide by ordinance for the levy and collection of personal property tax on motor vehicles trailers semitrailers and boats which have acquired a situs within such locality after the tax day for the balance of the tax year. 1 day agoBut higher assessed values mean higher personal property tax bills.

All other tangible personal. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Outdoor advertising signs regulated under Article 1 332-1200 et seq of Chapter 12 of Title 332.

Team Papergov 11 months ago. Thats the amount of lead time thats necessary so that vehicle tax bills can go out on time in May. Personal Property Registration Form An ANNUAL filing is required on all.

To visit the site register your alarm or make a payment visit Cry Wolf. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts excluding the rental of vehicles licensed by the state from rental of personal property for 92 consecutive days or less. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. All tangible personal property employed in a trade or business other than that described in subdivisions 1 through 17 which shall be valued by means of a percentage or percentages of original cost.

January LES must be presented each year to verify tax relief. Page Content Please input the value of the vehicle the number of months that you owned it during the tax year and click the Calculate button to compute the tax.

Car Insurance Claim Guidelines 2021 Car Insurance Claim National Insurance Car Insurance

Confederate Monuments Topple In Richmond Virginia Reveal

Public Housing In Richmond Virginia Richmond Cycling Corps

How Decades Of Racist Housing Policy Left Neighborhoods Sweltering The New York Times

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

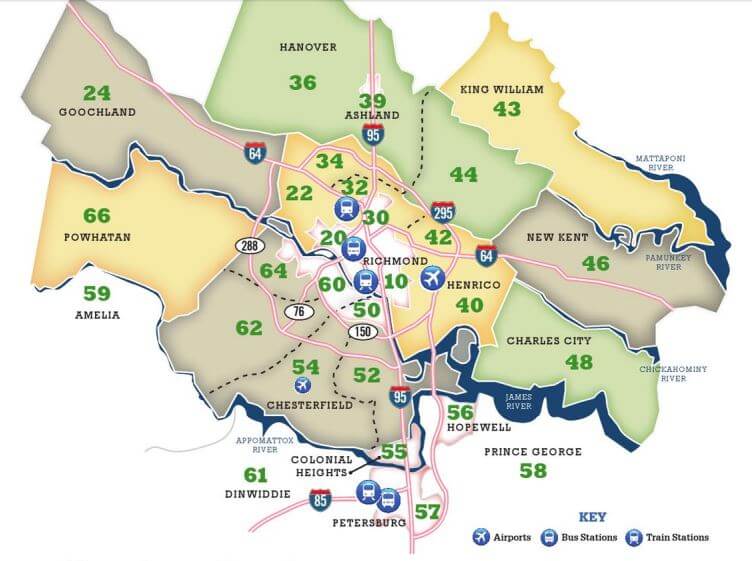

Guide To Richmond Area Mls Real Estate Zones Mr Williamsburg

Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders